Catching a Falling Knife

So far in this series, we’ve been looking at long term general market conditions with an overall bullish se...

The Presidential Cycle is a four-year cycle where the US Stock Market seems to make similar returns in each of the four years. I.e. We compare all the years of the election (2020, 2016, 2012…) and the results seem to align.

The Presidential Cycle is a four-year cycle where the US Stock Market seems to make similar returns in each of the four years. I.e. We compare all the years of the election (2020, 2016, 2012…) and the results seem to align.

The most common theory behind the cycle is that there is more spending in years leading up to a Presidential Election and that leads to Stock Market gains. Another reason is that fund managers tend to take a “wait and see” approach when there is a change in administration, so the buying pressure is lower.

Regardless, there is a general pattern that we can take advantage of if we dig in and have a look at what history has to tell us.

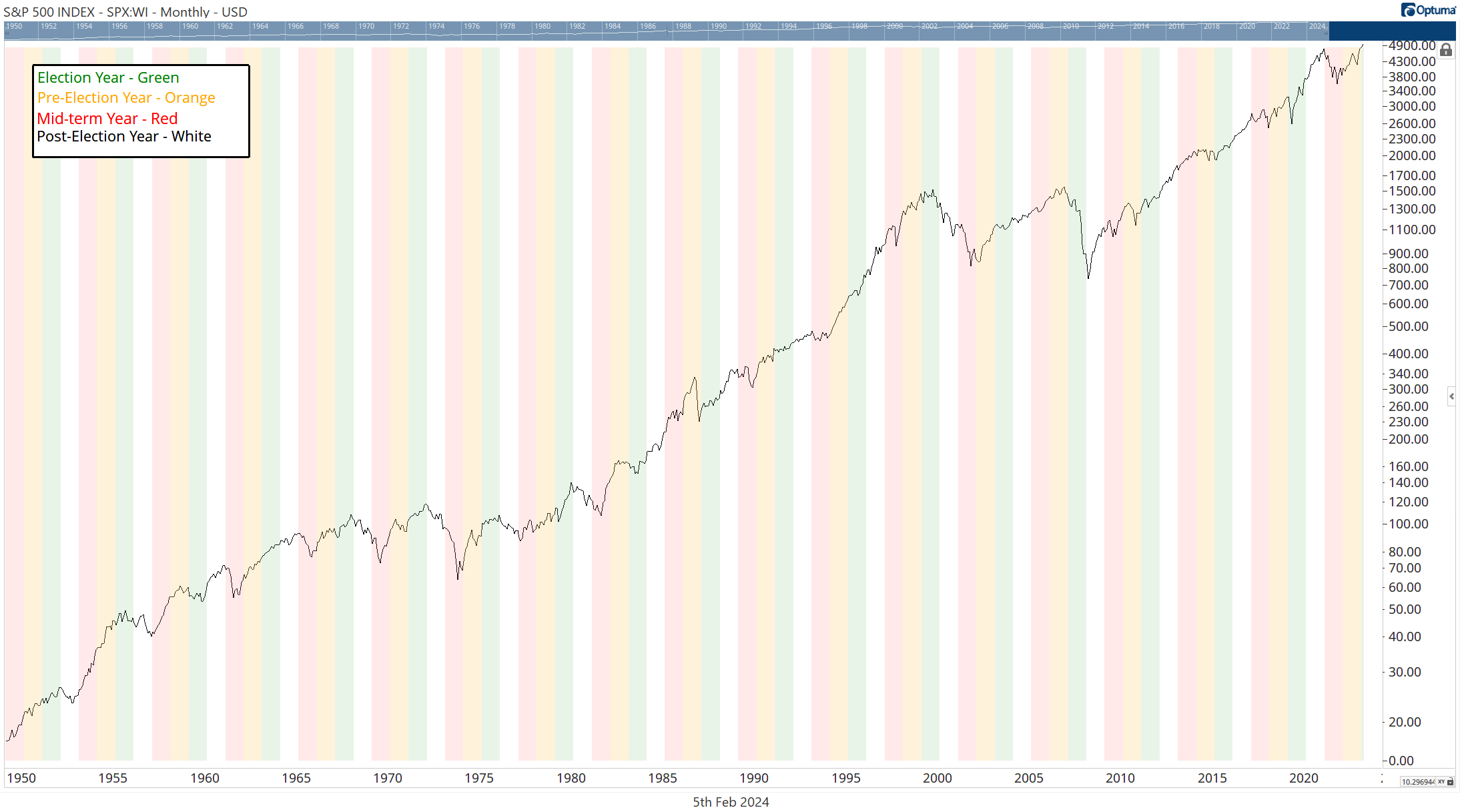

Chart 1: S&P 500 with Presidential Years Highlighted. Courtesy Optuma.com

Chart 1: S&P 500 with Presidential Years Highlighted. Courtesy Optuma.com

In Chart 1, we can see the past 70 years of the S&P 500. On the chart I have highlighted each of the cycle years. This is a great visual, but there is not much we can do with this on its own.

Instead, we can do a small quantitative analysis to determine the average returns for each of these years and also the Probability that the year will end up (positive).

Let’s look at the four years in the cycle:

Year 1: Post-Election Year

Average Return is 4.7%

Probability of a Positive Year is 56%

Year 2: Mid-Term Year

Average Return is 2.3%

Probability of a Positive Year is 65%

Year 3: The Pre-Election Year.

Average Return is 11%

Probability of a Positive Year is 88%

Year 4: Election year (we are here now!)

Average Return is 7.4%

Probability of a Positive Year is 83%

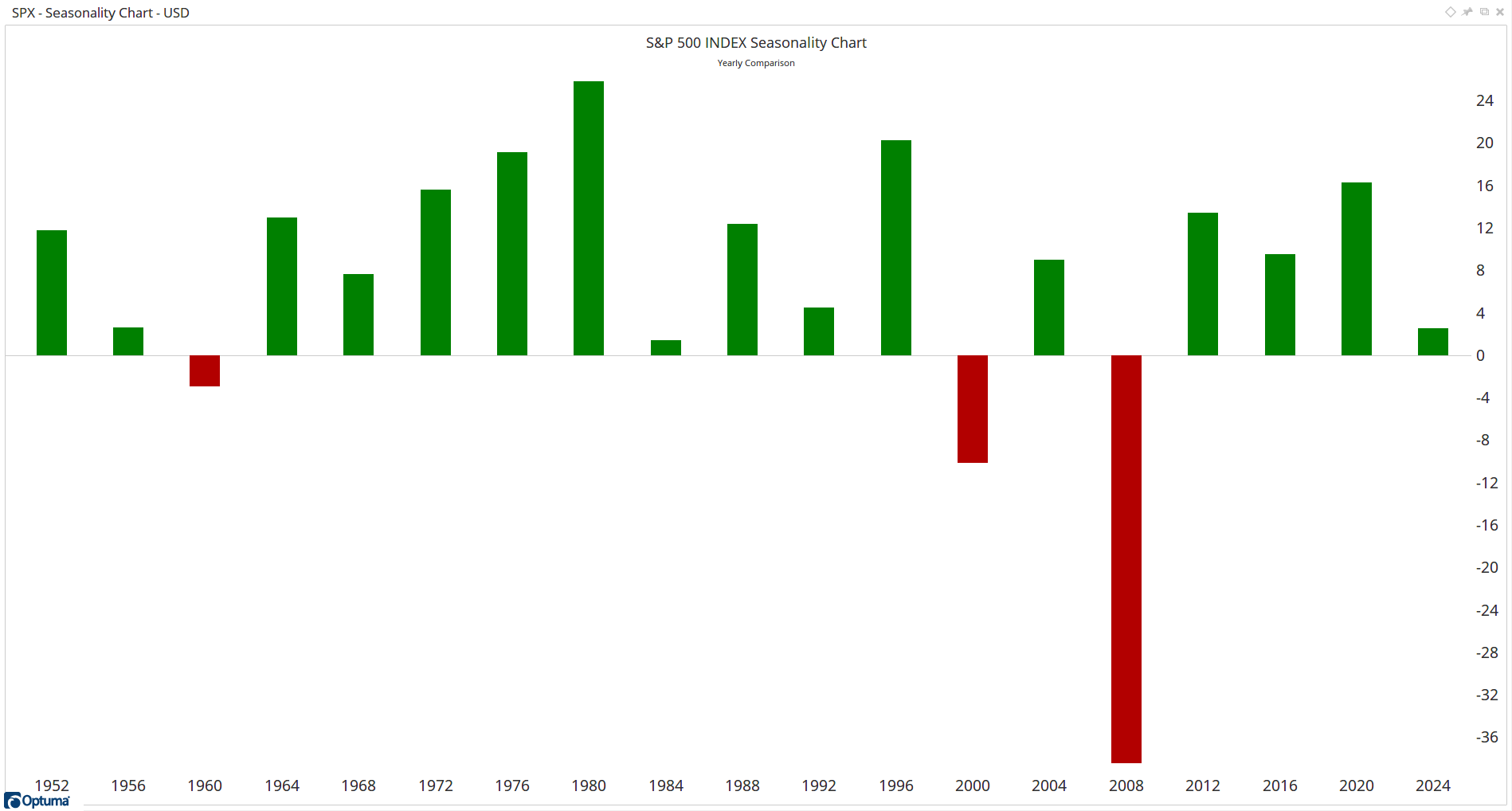

It’s always good to look inside the numbers and view what made up the average. In Chart 2, we look at all the Election years on a Seasonality Chart and we can see how the majority of Election years end with the SPX higher.

Chart 2: Return of each Election Year. Courtesy Optuma.com

Chart 2: Return of each Election Year. Courtesy Optuma.com

What jumps straight out is that there have only been three bad Election Years in the past 70 years. What is also interesting is those three elections saw a change in which party won the White House:

1960 : Kennedy defeated Nixon

2000 : Bush defeated Gore

2008 : Obama defeated McCain

So there are two conclusions:

Of course, there are many caveats with any conclusions like this. As Technical Analysts we do not observe something and assume that it is an immutable fact. Rather we see it, take note, and consider it in light of our other analysis.

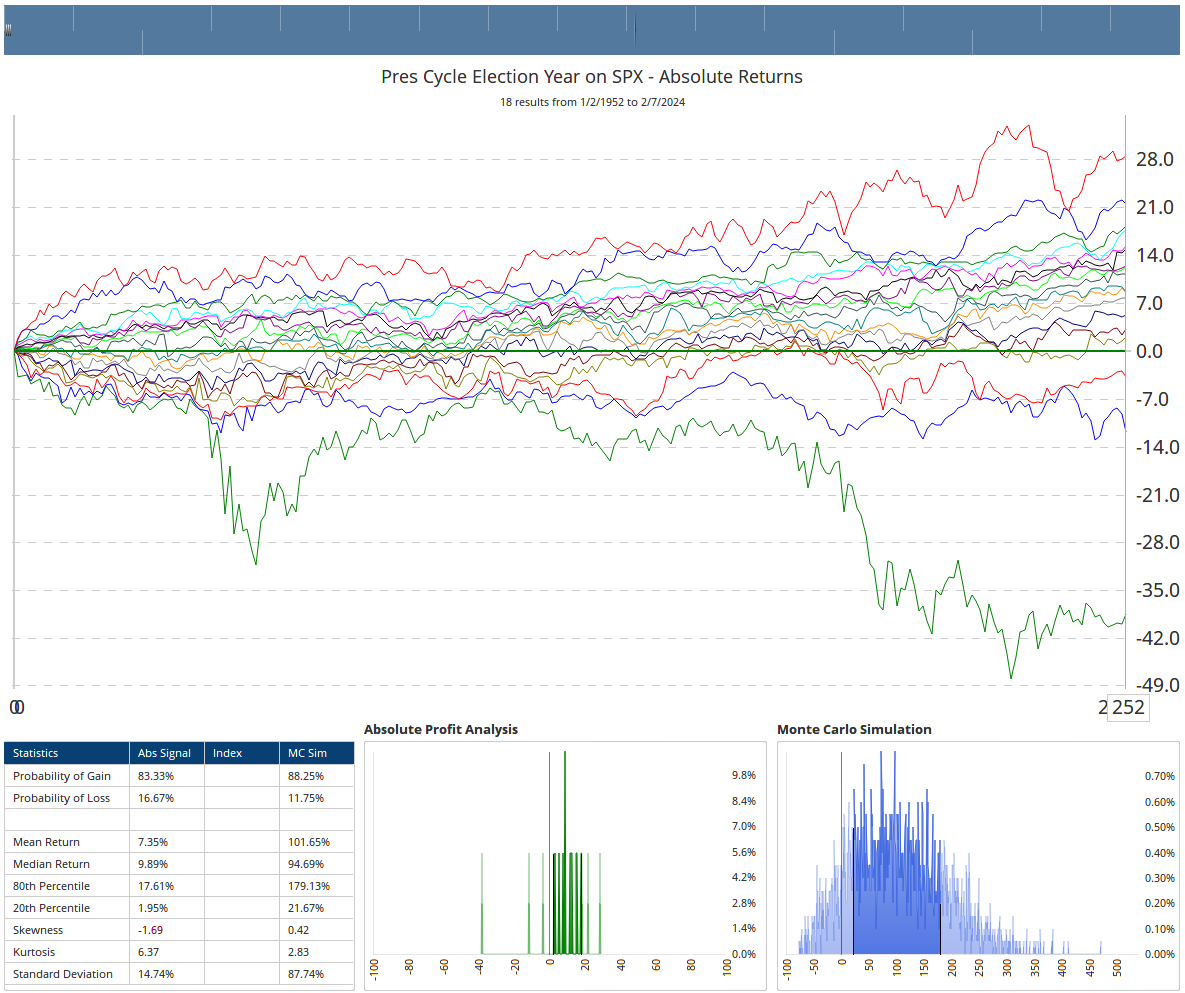

One way that we can dig in further is to examine the average path taken during all the Election Years. Chart 3 shows an Optuma Signal Test result. The main plot is the average of each of the Election Years from the start of the year to the last trading day (252 trading days in a year).

Chart 3: Average Election Year Returns. Courtesy Optuma.com

Chart 3: Average Election Year Returns. Courtesy Optuma.com

The average behavior is for the market to be sideways for the first 60 days and then start making gains until the Election is getting close. There is uncertainty about who will win and most large investors are minimizing exposure to potential volatility around the election day.

In the final 60 days, after the election until the end of the year, the certainty of what is coming gives investors the confidence to jump back into the market and we usually see a final rally into Christmas.

So far this year, the S&P 500 is up 4.6%. That’s considerably more than the average flat 60 days that we saw in Chart 3. So what can we expect from here?

To get an idea, we can have a look at the Individual Component Years in Chart 4. It’s just a different version of Chart 3 but instead of showing the combined average, we are seeing each of the years that made up the average.

Chart 4 Component Election Year Returns. Courtesy Optuma.com

Chart 4 Component Election Year Returns. Courtesy Optuma.com

What jumps out is that those years that started well finished well. Look at the Red line in Chart 4 (1980), it was at 8.8% by this same time in the year and it finished at 28% gain. In Contrast, 2008 started down -3.5% and finished the year nearly 40% down.

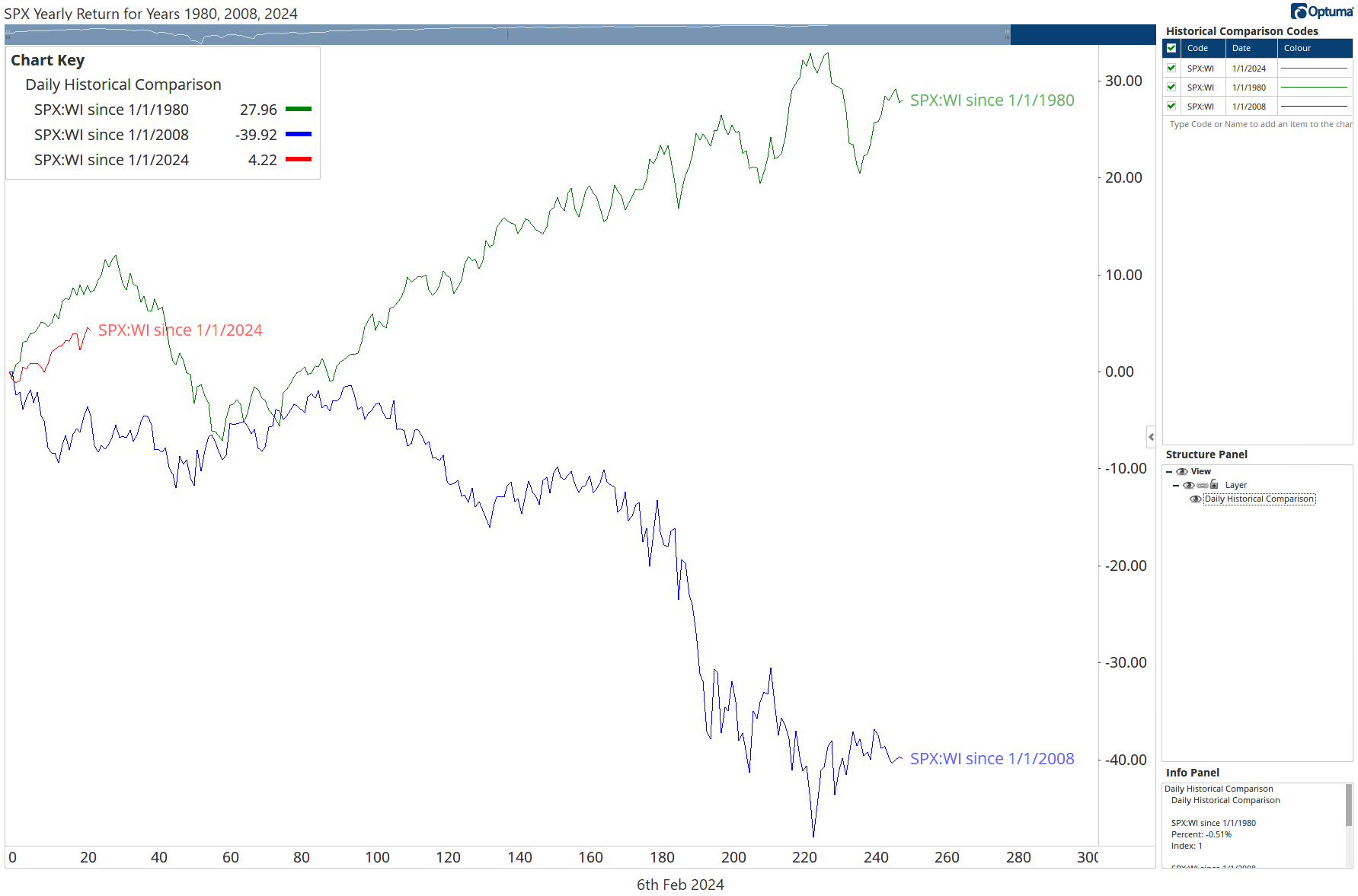

I’ve repeated those two years with 2024 in Chart 5. Again, while there are no guarantees in financial analysis — we deal in probabilities based on past observations — based on the historical results, the signs are good for 2024 to finish the year strongly.

Chart 5. SPX Yearly Return for Years 1980, 2008, 2024

Chart 5. SPX Yearly Return for Years 1980, 2008, 2024

All full size charts can be viewed online at Presidential Cycle Charts - Investopedia Chart Advisor - Feb 6 | Optuma Publishing

Get blog updates and Optuma News